In brief

In the recent decision of Janesh s/o Rajkumar v Unknown Person (“CHEFPIERRE“) [2022] SGHC 264, the Singapore High Court found that NFTs can be regarded as property, and a proprietary injunction may be issued by the Court to prevent the dissipation of NFTs.

This decision follows the tenor of the Singapore High Court’s earlier decision this year in CLM v CLN [2022] SGHC 46 (“CLM”), which established that cryptocurrency could be classified as property that could be protected via proprietary injunctions. Our client update on CLM may be accessed here.

- While the decentralised nature of blockchains may pose difficulties when it comes to establishing jurisdiction, there must be a court which has the jurisdiction to hear the dispute. The primary connecting factor contemplated by the Court was the fact that the Claimant was located in Singapore and carried on his business here.

- The Claimant’s failure to identify the name and identification number of the person behind the account known as chefpierre.eth (“Defendant“) did not amount to a failure to comply with the Rules of Court 2021 (“ROC 2021“). The Court will interpret the ROC 2021 purposively and ensure that access to justice is not overtly restricted. That said, the description of the Defendant must be sufficiently certain so as to identify who would fall under such description.

- Substituted service may be effected on a Defendant out of jurisdiction. Here, the Court had allowed the Claimant to serve the cause papers and orders made on the Defendant’s Twitter, Discord accounts and messaging function of the Defendant’s cryptocurrency wallet address.

- Under Singapore law, NFTs may be recognised as property under the classic definition established in National Provincial Bank Ltd v Ainsworth [1965] AC 1175 (“Ainsworth“). Thus, NFTs are capable of giving rise to proprietary rights which could be protected by a proprietary injunction.

Background facts

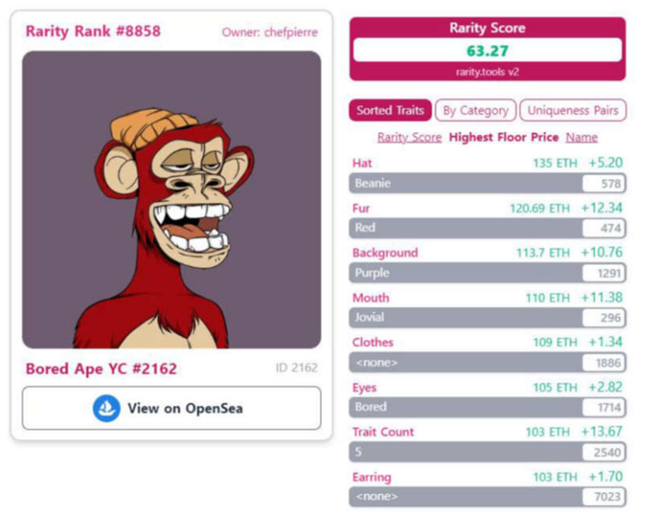

In the present case, the Claimant was the owner of an NFT known as the Bored Ape Yacht Club (BAYC) ID #2162 (“Bored Ape NFT“).

Image source: Janesh s/o Rajkumar v Unknown Person judgment

He had entered into several loan agreements with the Defendant to borrow cryptocurrencies with the Board Ape NFT as collateral. These loan agreements would include several provisions which allow the Claimant a reasonable opportunity to make full repayment of the loan, before the Defendant could “foreclose” upon the Board Ape NFT.

In one such loan agreement, the Claimant communicated with the Defendant that he would require a short extension of time for repayment. In response, the Defendant agreed to the extension, and reassured the Claimant that the Bored Ape NFT would be returned to him once the loan was repaid in full.

Subsequently, the Defendant changed his mind and indicated that it would foreclose upon the Board Ape NFT in 2 days if the Claimant failed to make full repayment. Following the Claimant’s failure to make full repayment, the Defendant refused to discuss the matter further and informed the Claimant that he would be keeping the Bored Ape NFT for himself.

Given the real risk of dissipation and disposal of the Bored Ape NFT, the Claimant made an urgent application to court for a proprietary injunction prohibiting the Defendant from in any way dealing with the Bored Ape NFT, and to serve a copy of said injunction on the twitter and discord account of the Defendant.

Procedural issues in cases involving unknown Defendants under the new Rules of Court 2021

The anonymity of the Defendant raised three procedural issues:

- Whether the Court has the jurisdiction to hear the application given that the domicile, residence and present location of the Defendant was unknown.

- Whether the Court has jurisdiction against an unknown person

- Whether the Court may grant an application for substituted service out of jurisdiction

On (a), the Court found that it has jurisdiction to hear the application. Notwithstanding the decentralised nature of blockchains, there must be a court which has the jurisdiction to hear the dispute. Based on the available facts, the Court held that the primary connecting factor was the fact that the Claimant was located in Singapore and carried on his business here.

As for (b), while the Court had previously granted interim orders against unknown defendants, the issue had not been raised under the new Rules of Court 2021 (“ROC 2021”).

- Under the new ROC 2021, the relevant forms for bringing an Originating Application requires the Defendant’s name and identification number to be stated. However, Order 3 rule 6 of the ROC 2021 also states that these forms must be used “with such variations as the circumstances require”.

- Accordingly, the Court did not consider the Claimant’s failure to name the Defendant as amounting to non-compliance with the ROC 2021. This is because the Court is required to interpret the ROC 2021 purposively and requiring strict compliance with the formality requirements may restrict access to justice.

- That said, the Court clarified that this did not mean that it was not necessary to comply with the formality requirements at all since that would make a mockery of the ROC 2021. Instead, the description of the Defendant must be sufficiently certain so as to identify both those who are included and those who are not.

Finally, on (c), due to the anonymity of the Defendant, the Claimant had applied to serve the cause papers and orders made on the Defendant’s Twitter and Discord accounts, and the messaging function of the Defendant’s cryptocurrency wallet address.

- While Order 7 r 7 of the ROC 2021 permits substituted service within Singapore, there is no provision allowing for substituted service out of Singapore.

- Nevertheless, the Court held that the ROC 2021 did not prescribe a closed list as to how service is to be effected out of Singapore. It therefore granted leave for substituted service out of jurisidction since it would otherwise deprive the Claimant of the only practical manner of effecting service on the Defendant.

The Court’s treatment of NFTs as property

In order for the Claimant to obtain an injunction against the Defendant, the Claimant had to show that he had a seriously arguable case that he had a proprietary interest in the Bored Ape NFT. Naturally, this rested on the assumption that the Bored Ape NFT, or NFTs in general, were capable of giving rise to proprietary rights which could be protected via a proprietary injunction.

The Court found that where NFTs (and more broadly, crypto assets) are concerned, it may not be entirely appropriate to characterise them as information, which conventionally cannot be regarded as property. NFTs, when distilled to the base technology, are not just mere information, but rather, data encoded in a certain manner and securely stored on the blockchain ledger. To characterise NFTs as mere information would ignore the unique relationship between the encoded data and the blockchain system which enables the transfer of this encoded data from one user to another in a secure, and verifiable fashion. The real objection to treating information as property depends on the functions it is used for rather than on the plain fact that it is information.

The Court noted that the trend of the case law concerning crypto assets has been to apply the criteria set out in Ainsworth. In order for an NFT to be regarded as property, it must be:

- Definable

- Identifiable by third parties

- Capable in its nature of assumption by third parties

- Possessed some degree of permanence or stability

On the facts, the Court found that NFTs could be regarded as property:

- First, the metadata of the NFT is unique, and distinguishes one NFT from another. After a NFT is “hashed”, any changes to the original image will result in a different hash value.

- Second, where NFTs are concerned, the presumptive owner would be whoever controls the wallet which is linked to the NFT. Similar to cryptocurrencies, excludability is achieved because one cannot deal with the NFT without the owner’s private key.

- Third, the nature of the blockchain technology gives the owner the exclusive ability to transfer the NFT to another party, which underscores the “right” of the owner. Further, such NFTs are clearly the subject of active trading in the markets.

- Fourth, the NFT concerned has as much permanence and stability as money in bank accounts which, nowadays, exist mainly in the form of ledger entries and not cold hard cash.

Conclusion

Singapore’s acceptance of NFTs as property marks the latest step forward for the protection of crypto assets. This is consonant with the growing trend to recognise and protect crypto assets, such as NFTs, as property, in foreign jurisdictions.

One notable and relevant case is the English decision of Osbourne v (1) Persons Unknown and (2) Ozone Networks Inc trading as Opensea [2022] EWHC 1021 (Comm). There, the English High Court similarly found that NFTs can be treated as property under English law. In that case, the English Court went on to issue a Bankers Trust disclosure order against a NFT marketplace platform which had hosted the unknown defendant’s crypto asset wallet.

It appears therefore likely that innovative and novel measures will continue to be applied by the Singapore courts (as well as courts in foreign jurisdictions) to ensure that parties have recourse to their legal rights in crypto assets such as NFTs in the future.

![Singapore Court recognises non-fungible tokens as property and grants interim injunction against persons unknown in Janesh s/o Rajkumar vs. Unknown Person (“CHEFPIERRE”) [2022] SGHC 264](https://globallitigationnews.bakermckenzie.com/wp-content/uploads/sites/50/2022/11/shutterstock_1439171585-1024x555.jpg)